With the end of the financial year fast approaching, what are some key accounting considerations and what is in store for financial report preparers in the years ahead? Below, we take a look at several critical issues to assist Australian entities with financial year end reporting obligations.

New ASIC definition of large proprietary company

For financial years commencing on or after 1 July 2019, the definition for large proprietary companies’ have effectively doubled. A proprietary company will be defined as ‘large’ for a financial year if it satisfies at least two of the following criteria:

- the consolidated revenue for the financial year of the company and any entities it controls is $50 million or more

- the value of the consolidated gross assets at the end of the financial year of the company and any entities it controls is $25 million or more, and

- the company and any entities it controls have 100 or more employees at the end of the financial year.

If an entity meets the definition of a large proprietary company, the entity is required to prepare and lodge its financial report and director’s report with ASIC.

The financial report must be audited unless ASIC grants relief.

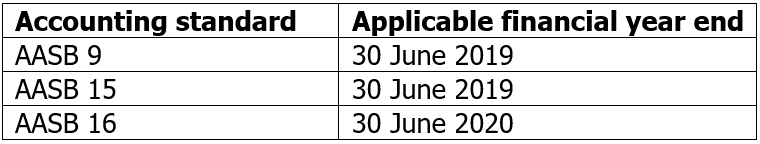

New Australian Accounting Standards

For a for-profit entity, the three new accounting standards that had a significant impact were:

- AASB 9 Financial Instruments

- AASB 15 Revenue from Contracts with Customers

- AASB 16 Leases

If you would like to find out more about AASB 15 and AASB 16 and how these standards impact your entity, please see our previous articles below for further guidance:

For a not-for-profit (NFP) entity, in addition to the three accounting standards above, AASB 1058 Income of Not-for-Profit entities and AASB 2019-4 Disclosure in Special Purpose Financial Statements of Not-for-Profit Private Sector Entities on Compliance with Recognition and Measurement Requirements will also need to be considered.

In terms of AASB 16 for NFP, it is worth noting that due to the difficulties NFP entities have experienced in determining the fair value of right-of-use assets arising under peppercorn leases, NFP entities have a temporary option to measure right-of-use assets at initial recognition at cost for the financial year ended 30 June 2020.

AASB 1058 clarifies the income recognition requirements applicable to NFP together with AASB 15. These two standards supersede all the income recognition requirements relating to NFP entities in the private sector and the majority of NFP entities in the public sector, including AASB 1004 Contributions.

For an NFP entity, the key factors to distinguish between the application of AASB 15 vs AASB 1058 depend on whether a transaction creates an enforceable right and obligation resulting from a sufficiently specific performance obligation. For example, in most instances, donations received would fall under AASB 1058 where it is not enforceable and perhaps fully non-refundable.

A NFP entity that prepares a special purpose financial report, following the issue of AASB 2019-4, will be required to comply with AASB 1054 Australian Additional Disclosures.

Focus of Regulators

From the most recent reviews conducted by ASIC, some common focus areas include:

- impairment of assets / asset values

- revenue / receivables recognition

- provisions and estimates given the level of uncertainty

- going concern consideration

As we start to see the wider impact of Covid-19 across our economy, it will be important for financial report preparers to consider the business and industry specific factors, overseas exposures, impact on supply chains and customers, and incorporate relevant disclosures into financial reports.

Looking ahead…the end of Special Purpose Financial Reporting

As part of the continuous reform of the financial reporting framework, the Australian Accounting Standards Board has recently issued the following accounting standards:

- AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Entities

- AASB 2020-2 Removal of Special Purpose Financial Statements for Certain For Profit Private Sector Entities

Under AASB 2020-2, certain for-profit entities in the private sector will no longer be able to prepare a special purpose financial report (SPFR) for financial years commencing on or after 1 July 2021, these entities will be required to prepare financial reports under Tier 2 general purpose financial report (GPFR). The financial report must comply in full with the recognition and measurement requirements of Australian Accounting Standards including the need for consolidation and/or equity accounting where applicable. SPFR will only be available in very limited circumstances.

The entities impacted will include:

- large proprietary companies

- unlisted public companies (other than companies limited by guarantee)

- financial services licensees

- small proprietary companies controlled by a foreign company

- small proprietary companies with crowd-sourced funding

Entities are encouraged to early adopt these reforms as all of the transitional relief listed below will be available to early adopters:

- Relief from distinguishing errors and changes in accounting policies

- Relief from comparative information for new disclosures

- Relief from restating comparative information

AASB 1060 simplified disclosure regime (SDR) is issued to support AASB 2020-2 and replace the existing reduced disclosure regime (RDR). For entities (both for-profit and NFP) that have already adopted RDR we will see a reduction in disclosures such as revenue, lessee & lessor disclosures, business combinations. For entities transitioning from SPFR to SDR, these entities will see an increase in disclosures particularly in the areas of related parties, financial instruments, revenue and tax. AASB 1060 has also introduced additional disclosures on audit fees and imputation credits which are currently not required under RDR.

AASB 1060 will not apply to entities that are under Tier 1 GPFR and we encourage you to contact your local Accru Felsers advisor for further details.