In the digital economy, the line between ‘contractor’ and ‘employee’ is blurring even more, as companies use consultants, contractors or freelancers on a project basis rather than hire full-time staff. Because thousands of one-person businesses are emerging in the gig economy – from air taskers to tech startups – the contractor vs employee question is even trickier.

Most of us understand the simple distinction between contractors and employees: An employee works in your business and receives superannuation, leave and other entitlements. A contractor runs their business, pays their superannuation, withholds tax and typically does not receive employee-like entitlements from clients.

However, there are many factors the Australian Taxation Office (ATO) looks at to distinguish who is a contractor vs an employee. First, let’s look at three common misconceptions.

- Myth: If the person providing services to your organisation has their own business, they must be a contractor.

Having a registered business name, Australian Business Number and submitting an invoice for work does not make someone a contractor. - Myth: If a person works less than 80% of their time for one business, they are a contractor.

A worker who supplies services to your organisation is not considered a contractor simply because they work less than 80 per cent of their time for your business. The 80/20 rule is a myth in determining contractor status. - Myth: Employers using contractors do not have to pay the contractors’ superannuation.

This is not necessarily true. If you are paying a contractor principally for their labour, you will most likely need to pay their superannuation.

Employers must consider seven factors

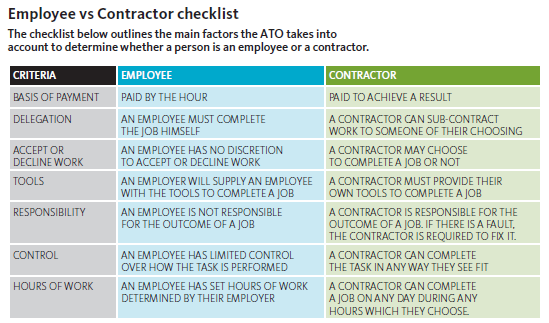

A company must look at many factors: can the contractor delegate work, how are they paid, do they provide their own tools or other assets, do they take commercial risks for the work, do they have more control over the work, and are they independent?

Are employers aware of this? Recent large cases in the media suggest not. Employers are exposing themselves to risk unwittingly, and the ATO is now placing considerable attention on this area. Businesses who force workers to be contractors with so-called ‘sham contracts’ are a particular focus.

However, it’s not just ‘dodgy’ cases that are being prosecuted. Negligence and naivety is enough to place you at risk.

One example is where a person worked for a large company through their small business, and over time, their hours increased, they were given daily instruction and pressured not to work for other companies. When the company terminated that person, the courts ruled that they were entitled to holiday pay, long-service leave, superannuation and redundancy payment for more than a decade of work.

It is critical to be informed of the consequences of who (and how) you employ, and how this impacts your obligations as a business.

How does the ATO determine who is a contractor vs employee?

The commissioner analyses each case on a balance of probabilities test, based on the criteria in the table below.

The rules are complex, but here is a simplified summary of the key facts:

- It does not matter what you call employees or contractors, the answer lies in how you interact with them

- You are obligated to pay the following for employees: Superannuation, PAYG Withholding tax.

The ATO heavily relies on their online decision tool, so make sure you put your business to the test!

Please also note that Workers’ Compensation Insurance and Payroll Tax is also payable for employees and potentially sub-contractors. However, these obligations are administered by State Governments that use different tests to determine who is an employee.

Accru Felsers is here to help

We understand that the distinction between contractor vs employee is not black and white – however we can offer extensive guidance and advice for your situation to ensure you are compliant.

Don’t get caught out with substantial debt and penalties because of a lack of attention to this issue. The above should be considered in every employment interaction. With planning and professional advice, employee vs contractor status is easily manageable.

If you’re a digital marketplace, see our article Employers vs Contractors for digital marketplaces for traps to avoid. Accru Felsers Sydney helps many businesses with tax issues that arise in the digital economy. Please contact us or your local Accru Felsers advisor for help.