Business investment, activity and confidence are clearly key foundations of the Government’s economic recovery plan. There are a variety of measures that affect small business, medium and large business and even one measure that transforms many medium businesses into “small” businesses for tax law purposes. Most of these measures come under a “JobMaker” heading in the Budget papers.

Instant asset write-off

The instant asset write-off was one of the key announcements and represents one of the largest Budget spends ever announced, with an expected cost of $27 billion.

Once the announcement passes into law, any business with a turnover of less than $5 billion will be able to write-off the full purchase value of any asset that was acquired between 7:30pm 6th October 2020 and 30 June 2022. This is expected to cover 95% of businesses and is a clear incentive to get businesses to purchase new equipment (as opposed to second hand equipment).

Full expensing in the year of first use will apply to new depreciable assets and the cost of improvements to existing eligible assets. For small and medium sized businesses (with aggregated annual turnover of less than $50 million), full expensing also applies to second-hand assets.

Businesses with aggregated annual turnover between $50 million and $500 million can still deduct the full cost of eligible second-hand assets costing less than $150,000 that are purchased by 31 December 2020 under the enhanced instant asset write-off. Businesses that hold assets eligible for the enhanced $150,000 instant asset write-off will have an extra six months, until 30 June 2021, to first use or install those assets.

This measure doubles as an incentive for businesses to purchase new equipment, whilst also presenting a marketing opportunity for businesses of all sizes which supply depreciable assets.

Carry back tax losses

The Government will allow eligible companies to carry back tax losses from the 2019-20, 2020-21 or 2021-22 income years to offset previously taxed profits in 2018-19 or later income years.

Corporate tax entities with an aggregated turnover of less than $5 billion can apply tax losses against taxed profits in a previous year, generating a refundable tax offset in the year in which the loss is made. The tax refund would be limited by requiring that the amount carried back is not more than the earlier taxed profits and that the carry back does not generate a franking account deficit. The tax refund will be available on election by eligible businesses when they lodge their 2020-21 and 2021-22 tax returns.

Victorian business support grants announced on 13th September will be tax free

The Government will make the Victorian Government’s business support grants for small and medium business as announced on 13 September 2020 non-assessable, non-exempt (NANE) income for tax purposes. Normally grants of this nature would be subject to income tax.

Eligibility for this treatment will be limited to grants announced on or after 13 September 2020 and for payments made between 13 September 2020 and 30 June 2021.

Small and Medium business – change to SBE tax concessions thresholds

Access to a range of Small Business Entity (SBE) measures will become available to many more businesses, as the Government plans on increasing the turnover threshold to qualify for SBE status. Current SBE tax concessions apply to businesses with aggregate turnover of under $10 million. This threshold will be increasing to $50 million.

This will be done in three phases:

- From 1 July 2020: immediately deduct certain start-up and prepaid expenditure

- From 1 April 2021: exempt from FBT on eligible car parking and multiple work-related portable electronic devices (such as phones or laptops) provided to employees.

- From 1 July 2021: simplified trading stock rules will be available, along with monthly settlement of excise and duty under SBE concessions. There will also be a 2 year amendment period, except for entities that have “significant international tax dealings or particularly complex affairs”.

Division 7A update

Changes to Division 7A have been announced dating back to the 2016-17 Budget and no doubt further consultation is needed before the final changes can be introduced as law. The start date for these changes has now been changed from 1 July 2020 to be the income year commencing on or after the date of Royal Assent of the enabling legislation.

Second Women’s Economic Security Package

This is the second instalment of a women’s economic security package and is announced as $231 million over 4 years. The programs in the package are:

- $90.3 million over three years from 2020-21 for concessional work test arrangements for Paid Parental Leave in response to COVID-19. Specifically, relaxing the Paid Parental Leave work test for births and adoptions that occur between 22 March 2020 and 31 March 2021 to allow parents to qualify for the payment if they have worked in 10 of the last 20 months, instead of 10 of the last 13 months, preceding the birth or adoption of a child

- $47.9 million over four years from 2020-21 to increase grants for the Women’s Leadership and Development Program, including funding for the Academy of Enterprising Girls and Women Building Australia

- $35.9 million over five years from 2020-21 (including $6.5 million in 2024-25) to increase the number of co-funded grants to women-founded start-ups under the Boosting Female Founders Initiative and to provide access to expert mentoring and advice for women entrepreneurs

- $25.1 million over five years from 2020-21 (including $3.0 million in 2024-25) to establish a Women in Science, Technology, Engineering and Mathematics (STEM) Industry Cadetship program to support 500 women working in STEM industries to complete an Advanced Diploma through a combination of study and work-integrated learning experiences

- $24.7 million over four years from 2020-21 to streamline the servicing arrangement of ParentsNext and modify the eligibility to provide assistance to parents most in need

- $14.5 million over four years from 2020-21 to extend or expand existing initiatives that support girls and women to gain STEM skills and capabilities, including the Women in STEM Ambassador, the Women in STEM Entrepreneurship Grants Program and the Girls in STEM Toolkit

- $2.1 million over three years from 2020-21 to establish a Respect@Work Council to assist in addressing sexual harassment in Australian workplaces.

Research and Development tax incentive changes

The Government is making further enhancement to measures announced in the 2019-20 MYEFO update. For small companies, those with aggregated annual turnover of less than $20 million, the refundable R&D tax offset is being set at 18.5 percentage points above the claimant’s company tax rate, and the $4 million cap on annual cash refunds will not proceed.

For larger companies, those with aggregated annual turnover of $20 million or more, the Government will reduce the number of intensity tiers from three to two. The R&D premium ties the rates of the non-refundable R&D tax offset to a company’s incremental R&D intensity, which is R&D expenditure as a proportion of total expenses for the year.

The marginal R&D premium will be the claimant’s company tax rate plus:

- 5 percentage points above the claimant’s company tax rate for R&D expenditure between 0 per cent and 2 per cent R&D intensity for larger companies

- 5 percentage points above the claimant’s company tax rate for R&D expenditure above 2 per cent R&D intensity for larger companies.

The Government will defer the start date so that all changes to the program apply to income years starting on or after 1 July 2021, to provide businesses with greater certainty as they navigate the economic impacts of the COVID-19 pandemic. All other aspects of the 2019-20 MYEFO measure will remain unchanged, including the increase to the R&D expenditure threshold from $100 million to $150 million per annum.

Corporate residency test

The Government will make technical amendments to clarify the corporate residency test and will amend the law to provide that a company that is incorporated offshore will be treated as an Australian tax resident if it has a ‘significant economic connection to Australia’. This test will be satisfied where both the company’s core commercial activities are undertaken in Australia and its central management and control is in Australia.

This will apply either from the date the law receives Royal Assent, or from 15 March 2017 if the company wishes.

Corporate Tax Rate – reminder

The Government remains committed to the 10 year enterprise tax plan announced four years ago. Attempts to extend the corporate tax cuts to companies over $50 million have failed thus far, but presumably the Government will continue to make efforts to pass them.

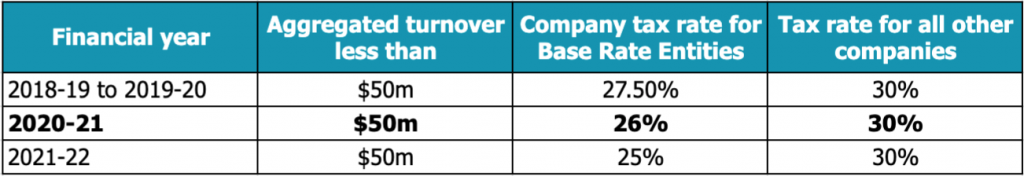

They have succeeded in bringing forward the tax cut for “Base Rate Entities”. A Base Rate Entity for 1 July 2018 onwards has aggregated turnover below $50 million and that has 80% or less of their assessable income as ‘base rate entity passive income’

Therefore, the current corporate tax rates are as follows:

EMPLOYMENT INCENTIVES

JobMaker Hiring Credit

In spite of opposition to the idea, the Government is intent on ending JobKeeper on 28th of March as currently scheduled. They want businesses to drive the economic recovery and part of the transition away from JobKeeper is the implementation of the new JobMaker Hiring Credit, targeting at those hardest hit by recent unemployment. It is budgeted as a $4 billion program.

The JobMaker Hiring Credit will be available to eligible employers over 12 months from 7 October 2020 for each additional new job they create for an eligible employee. Eligible employers who can demonstrate that the new employee will increase overall employee headcount and payroll will receive:

- $200 per week if they hire an eligible employee aged 16 to 29 years; or

- $100 per week if they hire an eligible employee aged 30 to 35 years.

The JobMaker Hiring Credit will be available for up to 12 months from the date of employment of the eligible employee with a maximum amount of $10,400 per additional new position created.

Eligibility criteria is:

- The employee will need to have worked for a minimum of 20 hours per week, averaged over a quarter, and;

- Received the JobSeeker Payment, Youth Allowance (other) or Parenting Payment for at least one month out of the three months prior to when they are hired.

Boosting apprenticeships wage subsidies

From 5 October 2020 to 30 September 2021, businesses of any size can claim the new Boosting Apprentices Wage Subsidy for new apprentices or trainees who commence during this period. Eligible businesses will be reimbursed up to 50 per cent of an apprentice or trainee’s wages worth up to $7,000 per quarter, capped at 100,000 places.

Supporting apprentices and trainees

The Supporting Apprentices and Trainees (SAT) wage subsidy has been extended, which is intended to keep apprentices and trainees employed.

The Supporting Apprentices and Trainees (SAT) wage subsidy reimburses eligible businesses up to 50 per cent of an apprentice or trainee’s wages. Subsidies are capped at $7,000 per quarter, per eligible apprentice or trainee.

From 1 July 2020 to 31 March 2021, small and medium-sized businesses (of less than 200 employees) can claim the SAT wage subsidy for apprentices or trainees who have been in-training with the business as at 1 July 2020. A wage subsidy is also available to eligible Group Training Organisations where the Host Employer of any size is receiving the JobKeeper payment and retains their apprentice or trainee.

Encouraging young Australians to undertake seasonal agricultural work

The restrictions on borders, both internationally and domestically, along with the implementation of JobKeeper, has created a short term labour crisis for many agricultural businesses. The Government will provide $16.3 million over three years from 2020-21 to incentivise seasonal participation in the agricultural industry, by creating a temporary pathway for young people who are seeking to qualify as independent for the purposes of assessing Youth Allowance (student) and ABSTUDY payment eligibility.

From 1 December 2020, those who earn at least $15,000 in the agricultural industry between 30 November 2020 and 31 December 2021 would be automatically assessed as meeting independence requirements, provided their parents meet current parenting income testing requirements.

Changes to temporary visas to support agricultural workforce

The Government has made temporary changes to allow temporary visa holders currently working in the agricultural sector to continue to work in Australia during COVID-19.

Working Holiday Maker (subclass 417 and 462) visa holders currently working in food processing or the agricultural sector will be eligible for a further visa and will be exempt from the six-month work limitation with one employer. Seasonal Worker Program and Pacific Labour Scheme workers, and other visa holders currently in the agricultural sector whose visas are expiring, may have their visas extended for up to 12 months to work for approved employers

FRINGE BENEFITS TAX

Reducing record keeping burden

The Government will provide the Commissioner of Taxation with the power to allow employers to rely on existing corporate records, rather than employee declarations and other prescribed records, to finalise their fringe benefits tax (FBT) returns. The measure will have effect from the start of the first FBT year (1 April) after the date of Royal Assent of the enabling legislation.

FBT exemption to support retraining and reskilling

The Government will introduce an exemption from FBT for employer provided retraining and reskilling benefits provided to redundant, or soon to be redundant employees where the benefits may not be related to their current employment. This measure applies from announcement.

Currently, FBT is payable if an employer provides training to redundant, or soon to be redundant, employees and that training does not have sufficient connection to their current employment.

THE MODERN MANUFACTURING STRATEGY

The onset of the worldwide pandemic and disruption to globalised supply chains highlighted a need to enhance self-sufficiency at a national level. The Government announced $1.5 billion over 5 years to support a ‘Modern Manufacturing Strategy’, to build competitiveness, scale and resilience in the manufacturing sector.

Six areas of “comparative advantage and strategic interest” have been identified. These are:

- Resources technology & critical minerals processing

- Food & beverages

- Medical products

- Recycling & clean energy

- Defence

- Space

See our separate coverage on Federal Budget changes announced affecting individuals and superannuation, If you would like to know more about how the Federal Budget announcements affect your business, please get in touch with your local Accru Felsers advisor.